In today’s competitive corporate landscape, employee and stakeholder incentives are pivotal in driving engagement, retention, and organizational success. Share-based concepts offer flexible, strategic models for distributing rewards, either as equity-based ownership (ESOPs) or cash-based appreciation (SARs). Companies need to choose the right model depending on their financial strategy, workforce dynamics, and growth objectives. This article explores the primary share-based models, their allocation mechanisms, and their broader implications.

1. ESOP Models: Ownership Through Equity

ESOPs (Employee Stock Ownership Plans) allow employees to acquire company shares, fostering a sense of ownership and aligning employee interests with organizational goals. Key models under ESOPs include:

a. MSOPs (Management Stock Option Plans)

- Designed for senior management, offering shares as part of their compensation.

b. PSOPs (Performance Stock Option Plans)

- Rewards tied to specific performance metrics (e.g., revenue growth, market share).

c. Sweat Equity Shares

- Given to founders, early contributors, or stakeholders for exceptional contributions.

2. SAR Models: Rewards Through Cash

SARs (Stock Appreciation Rights) provide rewards linked to the appreciation in the company’s share value, typically without issuing actual shares. These models are ideal for cash-based incentives without equity dilution.

a. Phantom Shares

- Simulates shareholding; rewards are based on the value of hypothetical shares.

b. CSOPs (Community Stock Option Plans)

- Targets external stakeholders like consultants, vendors, or community contributors.

Key Considerations for Choosing the Right Model

- Allotment Mechanics:

- ESOPs involve actual equity allocation, whereas SARs are purely cash-based.

- On Exercise:

- ESOPs dilute equity but increase ownership participation. SARs create a liability without equity impact.

- Cash Flow:

- ESOPs impact equity financing; SARs demand liquidity for cash payouts.

- Issued to:

- ESOPs target employees, founders, or key contributors, while SARs extend to external stakeholders.

- Impact on Financials:

- ESOPs increase equity capital and employee benefit expenses. SARs appear as liabilities, affecting profitability.

- Taxation:

- ESOPs are taxed as perquisites during exercise and capital gains during sale. SARs are taxed as salary or professional income.

- Valuation:

- Both models require precise valuation to meet compliance and ensure fairness in reward distribution.

Why Do ESOPs Hold Greater Value Than Traditional Incentives?

- For Top executives, after giving certain cash component as their remuneration, they feel it is enough. So they want more beyond monetary compensation.

- To encourage them for ESOPs, promoter need to convince them by showing them the clear picture for the valuation & growth and their involvement in such journey

What Do Surveys Reveal About the Adoption of ESOPs Among Private Companies in India, and Which Sectors Lead the Way?

- Employee Stock Ownership Plans (ESOPs) have become increasingly prevalent among private companies in India, particularly within the technology, media, telecom, and financial services sectors.

- A report by Grant Thornton Bharat indicates that over 50% of surveyed companies have implemented long-term incentive plans, with the technology, media, and telecom sector leading at 79%, followed closely by financial services at 74%.

Key Components of a Successful ESOP Policy

Eligibility Criteria

Establishing clear eligibility rules ensures fairness:

- Tenure-Based Eligibility: Employees with at least 1 year of service are eligible.

- Performance-Based Eligibility: Employees must meet specific Key Result Areas (KRAs) or Key Performance Indicators (KPIs).

Vesting Schedules

Vesting schedules determine the timeline over which employees earn full ownership of their allocated shares:

- Tenure-Based Vesting: Encourages long-term loyalty. For instance:

- 25% vested after Year 4.

- 50% vested after Year 5.

- 75% vested after Year 6.

- 100% vested after Year 8.

- Performance-Based Vesting: Tied to measurable objectives like revenue targets, customer acquisition, or market expansion.

Overcoming ESOP Challenges:

For instance: a private limited company grants performance-based ESOP to marketing manager with the following vesting conditions:

Marketing Manager: Performance-Based ESOP

Plan Overview:

- To enter through marketing in 5 cities in Year 1.

- 5 cities in Year 2.

- 5 cities in Year 3, with each city contributing ₹1 crore annually.

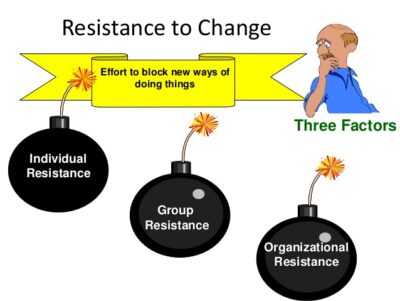

Challenges:

- Economic downturns affecting market conditions.

- Misalignment between short-term and long-term goals.

Resolution:

- Introduced a weighted scoring system, granting partial points for achieving 75% of the target.

- Allocated additional marketing resources to underperforming cities.

Conclusion: Tailoring Share-Based Models to Strategic Goals

Tailoring share-based models like ESOPs and SARs to an organization’s strategic goals is essential for maximizing their impact. Start-ups often prefer ESOPs to build loyalty and conserve cash, while mature companies may opt for SARs to reward stakeholders without diluting equity. With thoughtful design, regulatory compliance, and strategic communication, these models can drive sustainable growth, enhance employee retention, and align performance with organizational objectives.

For expert guidance in crafting or refining ESOP or SAR policies to meet your unique needs, connect with us at info@sncoglobal.com Empower your workforce and partners with the right plan today!