When does an organization feel cash crunch to operate successfully or in the normal way?

Many business owners start with a great idea, and they put their capital into establishing and growing their business. More customers mean more inventory, more staff, more training… more of many things.

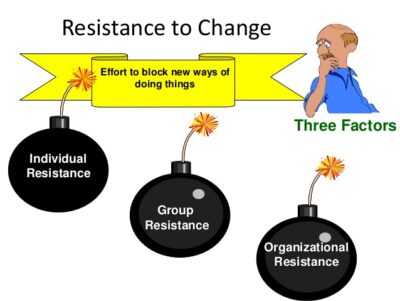

With this growth, business managers are then forced to choose between storing cash for a rainy day and investing for growth. It is often a gamble, and the worst outcome is when a business invests and then – for some unforeseen reason – business weakens and money dries up.

How to anticipate cash flow problems?

But a cash flow crisis doesn’t have to take you by surprise. Understanding the warning signs of a potential cash flow problem and better planning out of your working capital on hand can help you prepare for the tough times and weather the storm successfully.

Here are five ways to control working capital crunch that you should heed to avoid a cash flow crisis:

- Allocate funds appropriately within four baskets – Inventory, receivables, fixed cost, R&D, or Marketing

- Within above, grade into A, B, C category like ‘X’ amount for ‘Grade A’ inventory and likewise

- Budget Capping of funds under each category

- Monitor each category minutely with a safety alarm

- Control emotions and be wise in deciding between blockage in existing business Vs new opportunities, often cash crunch sucks your growth